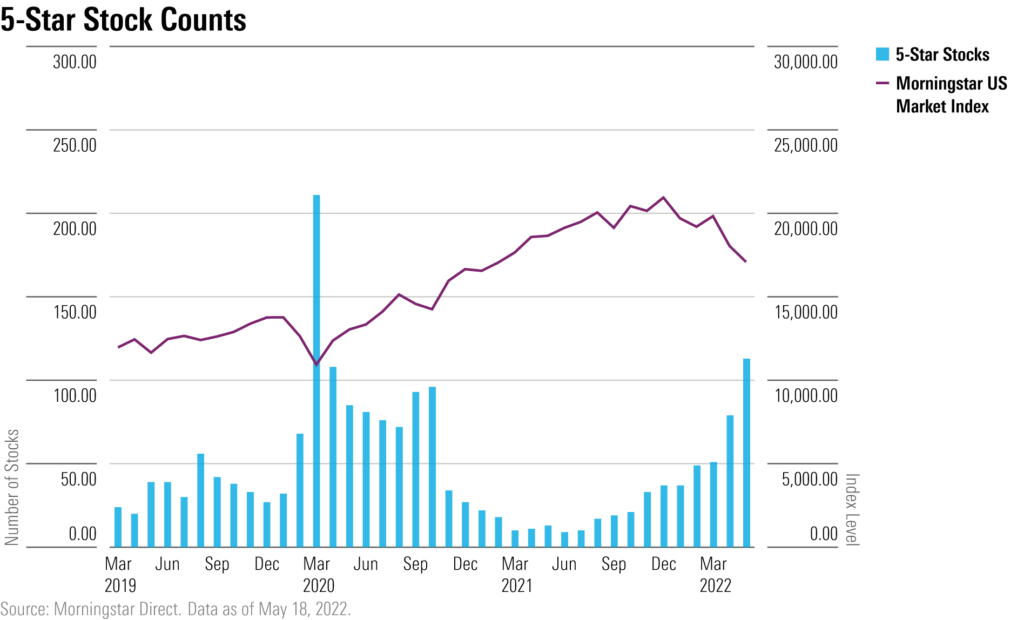

5starsstocks – Understanding and Investing!

Investing in high-quality stocks is one of the most effective ways to grow wealth and secure financial stability. Among the vast array of investment strategies, focusing on five-star stocks is a proven approach that many seasoned investors use to identify undervalued opportunities in the stock market.

These stocks are often considered gems, offering significant potential for growth while providing a cushion of safety due to their intrinsic value. This article will explore what five-star stocks are, how they are identified, and the strategies investors can use to maximize their potential.

Table of Contents

What Are Five-Star Stocks?

Five-star stocks are stocks that are rated highly by analysts based on a comprehensive evaluation of their financial health, market position, and growth potential. These stocks are typically considered to be undervalued, meaning their current market price is lower than their intrinsic or fair value.

This valuation disparity creates an opportunity for investors to buy these stocks at a discount, with the expectation that the market will eventually recognize their true worth, resulting in significant gains.

The criteria for identifying a five-star stock often include:

- Strong Fundamentals: A history of consistent revenue and profit growth, robust cash flow, and low levels of debt.

- Competitive Advantage: Companies with unique products, patents, strong brand recognition, or economies of scale that give them an edge over competitors.

- Market Potential: A demonstrated ability to capitalize on market trends and grow within their industry.

- Valuation Metrics: Low price-to-earnings (P/E), price-to-book (P/B), or price-to-sales (P/S) ratios compared to peers.

By focusing on these characteristics, investors can identify companies that are not only well-positioned for long-term growth but also provide a margin of safety against market volatility.

Characteristics of Five-Star Stocks:

While there is no universal standard for what constitutes a five-star stock, these investments typically exhibit several defining traits:

1. Strong Financial Performance

Five-star stocks often belong to companies with a history of strong financial performance. This includes consistent growth in revenue, earnings, and dividends. Companies with robust financials are better equipped to weather economic downturns and sustain their growth trajectory over time.

2. Resilient Business Models

A solid business model that can adapt to changing market conditions is a hallmark of five-star stocks. Companies with diversified revenue streams, innovative products or services, and a focus on long-term strategies are more likely to succeed.

3. Undervaluation

A key factor that sets five-star stocks apart is their undervaluation. These stocks are often overlooked by the market due to temporary challenges or market inefficiencies, creating an opportunity for investors to buy them at a discount.

4. Competitive Moat

The term “moat” refers to a company’s ability to maintain its competitive edge and protect its market share from competitors. A strong moat can be created through brand loyalty, proprietary technology, or cost advantages.

5. High Potential for Growth

Five-star stocks are typically associated with industries or sectors that are poised for significant growth. Whether it’s technology, healthcare, or renewable energy, these companies have the potential to capitalize on emerging trends and capture new markets.

Why Invest in Five-Star Stocks?

Investing in five-star stocks offers several advantages:

- Superior Returns: By identifying stocks that are undervalued but have strong fundamentals, investors can benefit from substantial capital appreciation over time.

- Reduced Risk: The intrinsic value of five-star stocks provides a margin of safety, which can help protect investors from significant losses during market downturns.

- Long-Term Growth: Five-star stocks are often associated with companies that have a proven track record of innovation and adaptability, making them ideal for long-term investors.

Strategies for Identifying Five-Star Stocks:

Investing in five-star stocks requires a disciplined approach and a thorough understanding of the factors that drive their performance. Here are some strategies that can help investors identify and select these stocks:

1. Fundamental Analysis

Conducting a detailed analysis of a company’s financial statements is critical. This includes examining key metrics such as revenue, net income, cash flow, and debt levels. Additionally, investors should evaluate profitability ratios, such as return on equity (ROE) and return on assets (ROA), to assess how effectively the company is utilizing its resources.

2. Valuation Metrics

Valuation metrics are essential tools for determining whether a stock is undervalued. The price-to-earnings (P/E) ratio compares a company’s stock price to its earnings per share, while the price-to-book (P/B) ratio measures the market’s valuation of the company relative to its book value. Low ratios relative to industry peers may indicate that the stock is undervalued.

3. Industry Trends

Understanding industry trends and market dynamics is crucial for identifying companies with high growth potential. Industries such as technology, healthcare, and renewable energy often feature companies that are well-positioned for future success.

4. Management Quality

The quality of a company’s management team plays a significant role in its success. Investors should look for companies with experienced leadership, a clear strategic vision, and a track record of executing their plans effectively.

5. Economic Moat

Companies with a strong economic moat are better positioned to maintain their competitive advantage over time. Identifying stocks with a durable moat can help investors build a portfolio that withstands market fluctuations.

Examples of Five-Star Stocks:

To illustrate the concept, let’s consider hypothetical examples of five-star stocks across different industries:

- Technology Sector: A software company with a dominant market position, innovative products, and recurring revenue from subscription-based services.

- Healthcare Sector: A pharmaceutical company with a strong pipeline of drugs and patents that provide a competitive advantage.

- Consumer Goods: A household-name brand that consistently generates revenue through its loyal customer base and extensive distribution network.

- Energy: A renewable energy firm capitalizing on the global transition to sustainable energy solutions.

- Financial Services: A bank with strong fundamentals, low debt, and a focus on digital transformation to meet evolving customer needs.

Key Risks to Consider:

While five-star stocks can offer substantial rewards, it’s important to be aware of the associated risks:

- Market Volatility: Even undervalued stocks can experience price fluctuations due to broader market trends or economic conditions.

- Company-Specific Risks: Factors such as management changes, regulatory challenges, or declining demand for products can impact a company’s performance.

- Overestimation of Growth Potential: Investors may misjudge a company’s ability to achieve its projected growth, leading to disappointing returns.

Building a Portfolio of Five-Star Stocks:

Diversification is essential when building a portfolio of five-star stocks. By spreading investments across different industries and regions, investors can reduce the impact of individual stock performance on their overall portfolio. Additionally, rebalancing the portfolio periodically ensures that it remains aligned with the investor’s financial goals and risk tolerance.

Conclusion

Investing in five-star stocks is a strategy that combines the principles of value investing with a focus on quality and growth potential. By identifying undervalued stocks with strong fundamentals and competitive advantages, investors can position themselves for long-term success in the stock market.

However, it’s essential to conduct thorough research, maintain a diversified portfolio, and remain vigilant about potential risks. With a disciplined approach and a clear understanding of the factors that drive stock performance, investors can unlock the full potential of five-star stocks and achieve their financial objectives.

Also Read: